We spoke with founders and top leaders of each of the top Customer Success Platforms and summarized our findings here to help you make the best possible purchase for your business.

Success leaders generally aren’t very good buyers of software. And mostly, it’s not their fault:

- There are very few Success tools available

- Success is already forced to use other departments’ tools (CRM, Ticketing, Support, etc.)

- Budgets for Success tools are usually tiny

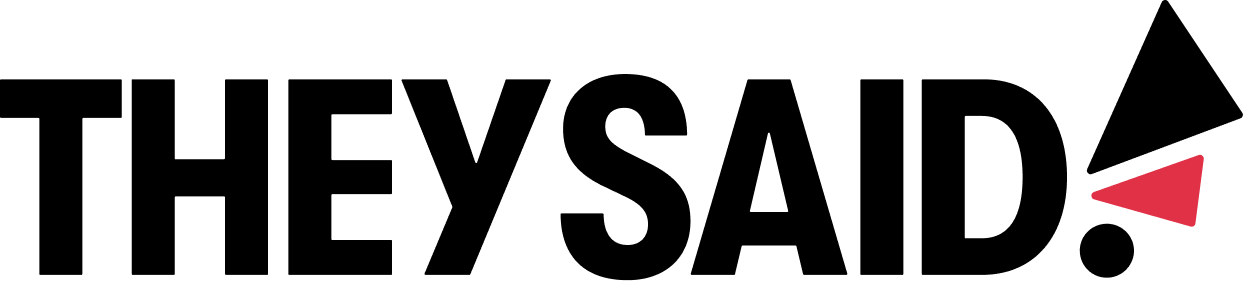

And while the technology landscape for Customer Success is growing, it’s still microscopic compared to tools available for Sales, Product, and Marketing.

Thanks to Jeff Breunsbach @ Higher Logic for developing this landscape as of mid 2022.

Higher Logic connects people, knowledge, and ideas to improve lives and organizations. Through our community solutions, we empower growth-stage businesses and associations to build a more engaged and meaningful relationship with their customers and members.

The landscape of tools can grow, but only after Success leaders demand more from vendors, investors, and finance leaders. That includes conversations about missing technology in board rooms, posts on social media, 1:1 sessions with tech company CEOs, better justifications for tool budgets, and sometimes building their own internal tools with engineering resources.

We’ll start with how to advocate for budget for your Customer Success Platform since Success leaders can immediately change how they pitch for tools.

Advocating for a budget for a Customer Success Platform

The formula to request more budget is fairly simple. You get more when you:

- Take on more revenue responsibility

- Focus on your department’s impact, not its efficiency

Let’s start with the worst way to advocate for Success budget and work our way up.

The WORST approach to asking for budget

“I need a new CSM plus tools budget for every $2M ARR managed”

This approach results in decreased Success budgets 100% of the time. The reason is that the CFO will view Success as a cost to support revenue—similar to Customer Support. The CFO often treats Success as the Cost of Goods Sold (COGS), increasing the company’s total COGS. This is a disaster for the Success team budget:

Gross Profit = Revenue - Cost of Goods Sold (COGS)

If the cost of the Success team is added to COGS, that means Gross Profit decreases! And just like you can count on the sun rising every day, you can count on the CFO doing everything in their power to increase Gross Profit over time, meaning increasing revenue and decreasing COGS.

If you discuss the ratio of CSMs to revenue managed, you’ll have a squeezed budget. Period.

A BETTER approach to asking for budget

“Give me an extra $1M in budget and I’ll return $3M in NRR gains”

This approach positions the Success team as a revenue driver, which moves Success out of COGS and over to Revenue. CFOs love investing in programs that will increase revenue, especially if that revenue can be acquired more efficiently than expensive channels like more SDRs or advertising budget.

Some Success leaders are hesitant to take on NRR responsibility. The general sentiment we’ve heard goes like this: “Why would I put my job at risk for some extra budget?” And the “real talk” answer is that the person who owns revenue has the better job. They have more influence, more power to make customers successful, more budget, a bigger team, get paid a higher salary, and don’t have to clean up after the mess that other departments make. Do any of those sound interesting!?

The BEST approach for asking for a budget to purchase a Customer Success Platform

“Give me an extra $1M, and the NRR gains will double the company’s value”

This is the best strategy to advocate for budget because it connects your department’s results to what the CEO and CFO care about most—increasing company value.

A 1% increase in NRR, on average, leads to a 0.7x increase in company value. In other words, increasing NRR by 3% will double the company’s value (2.1x increase).

Now you own a number that not only increases the company’s growth and profitability, you also own a number that significantly drives company value. Where else can the CFO invest to produce that kind of return on company value?

If you use this strategy to increase your budget, spend some of it with TheySaid!

Preparing your foundational process and data for a Customer Success Platform

Before taking advantage of a Customer Success Platform (CSP), you must implement a few critical systems and processes.

Pre-Purchase Checklist for Buying a Customer Success Platform

- Structured, repeatable processes for CSMs which can be turned into playbooks

- A single source of truth that you can trust, like a CRM

- Integrations that reliably transfer data from other systems to the single source of truth

- A method to gather qualitative customer insights - pulses (e.g. Nuffsaid), surveys, or NPS

- Standardized product usage metrics (time in app, utilization, key features, logins/week, etc.)

- Relatively clean data that can be used to trigger actions in the CSP

- A dedicated CS Ops or Sales Ops person available for integrations and data management

- A person or team available for CSM training and building new habits

If you don’t have these things, your Customer Success motion will be considered immature. And that will lead to these negative outcomes:

- Customers will suffer from a weak process that doesn’t maximize the value they receive from the product.

- Software vendors will think your account is less attractive because they’ll either need to invest in many professional services to help you level up or risk low engagement from your account because you don't have the foundations in place.

- The CEO and exec team will see the lack of adoption and firefighting as wasted time and money and will hurt your executive credibility.

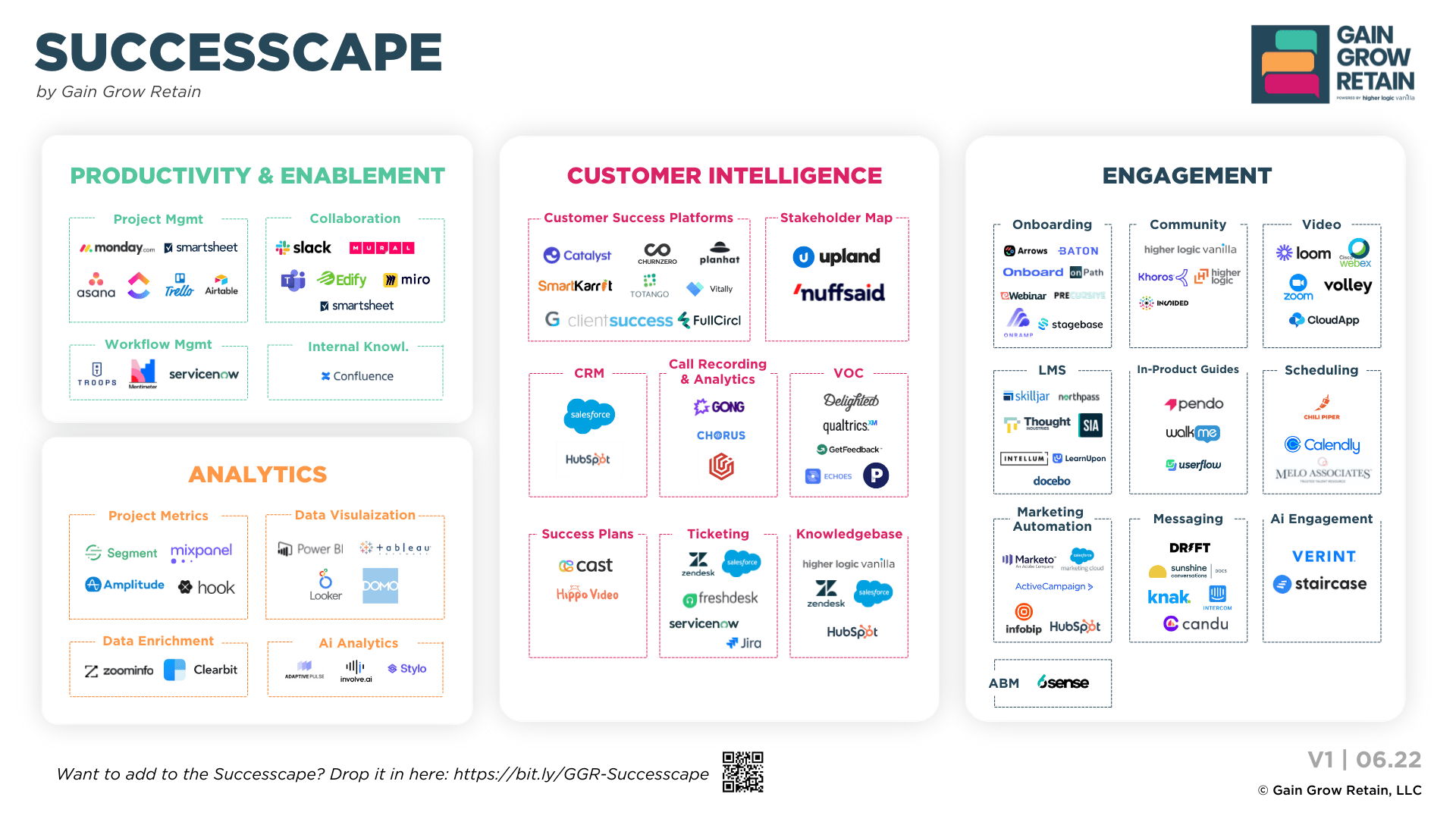

Customer Success Platform Comparison Chart

One of the biggest purchasing decisions, in terms of implementation time, process changes, and cost, is the purchase of a Customer Success Platform. To help you with your research, we interviewed all of the top CSPs and compiled the results of those conversations into the table below.

Here are a few notes to help you quickly scan the table of Customer Success Platforms:

- This chart is accurate as of Sept 1, 2022

- SMB = 1-500 employees, Mid Market = 501-5000 employees, Enterprise =5000+ employees

- High touch = a dedicated CSM model, Low touch = a pooled CSM or Tech touch model

- Built-in usage tool means the company offers their own product usage feature

- Data warehouse integrations allow CSPs to access data when other integrations are missing

- The time to launch is the time it takes to start using the platform. Any customizations, onboarding, or training will significantly increase these estimates.

- Included capabilities have a green ✔, and missing capabilities have a red ✘

Download the PDF of the Customer Success Platform Comparison Chart

Buying a Customer Success Platform — In their words

We asked each company how they’d describe their company to a potential buyer, and here are their responses.

Catalyst

If you have a CSP, but your team hasn’t adopted it, it’s time to talk to Catalyst. Catalyst has super high utilization rates compared to other offerings. Everything in the platform is structured to follow this flow: Insights → Action → Impact, emphasizing visibility into how Success moves the needle on health score, net retention rate, and more.

ChurnZero

Like marketing teams use Hubspot to automate marketing, Success uses ChurnZero to automate the customer experience. You don’t need a dedicated admin to implement and run ChurnZero. And ChurnZero provides the full ecosystem of partnerships, conferences, education, and content that other players (who target bigger companies) provide to their customers.

ClientSuccess

The first platform built by experienced CS professionals for CS professionals, ClientSuccess is focused on marrying simplicity with power. ClientSuccess provides a full-service Customer Success platform (onboarding, full renewal management, forecasting) for teams wanting to start quickly.

CustomerSuccessBox

“Don’t optimize your purchase based on the technology. Instead, choose the best partner to help you adopt the product.” CustomerSuccessBox will try harder with additional support and services to ensure you adopt the customer success platform.

Gainsight

Start and Scale your Modern Growth Engine. Gainsight Essentials is designed to address the problem that customers try to roll out too much functionality too quickly. With Essentials, you start with the core features and automation for High and Low touch and then easily scale into more complex products as your business evolves.

Planhat

The UX of modern tools with the power of mature platforms. In Planhat you can create multi-sequence automation based on any data source (Planhat data, data warehouse, product usage, tracking script, or Excel import), which triggers field updates, notifications, emails, API calls, webhooks, etc. Planhat started as an onboarding company (that capability is core) and then evolved into a Customer Platform.

Totango

The Composable Customer Success Platform. Things are always changing, and Totango is easy to compose your own journey, and it’s easy to adjust and change. Their modular approach to building the customer journey allows you to build pieces of your CS motion without launching everything at once.

SmartKarrot

Democratized Customer Success and augmented intelligence. We all have too much data and too many tasks, so SmartKarrot uses augmented intelligence to prioritize the data, tasks, and campaigns that move the needle.

Final Thoughts on Buying a Customer Success Platform

Making a CSP decision is so critical to your team's success that it’s important to pick the right CSP for the right size and stage of your company.

In our research, we learned a lot about each company, their mission, how they think about building their products, and who they do the best job supporting. If you ever want my advice on which CSP to pick for your business, let’s connect on LinkedIn, and I’ll share my opinions with you: www.linkedin.com/in/chrishicken.

There are some great existing and emerging companies in the category. When you do your own research, verifying that the feature lists above are still accurate will be important.

Wishing you Success!

CONTRIBUTORS

Written by Chris Hicken. Thank you to everyone who contributed to this article, including Jeff Breunsbach at Higher Logic for sharing the Successcape, Sydney Strader at Catalyst, Hunter Montgomery at ChurnZero, Dave Blake at ClientSuccess, Puneet Kataria at CustomerSuccessBox, Kellie Capote and Scott Salkin at Gainsight, Chris Regester at Planhat, Prithwi Dasgupta at SmartKarrot, Anne Ting and Karen Budell at Totango. Vitally did not respond to interview requests for this piece.